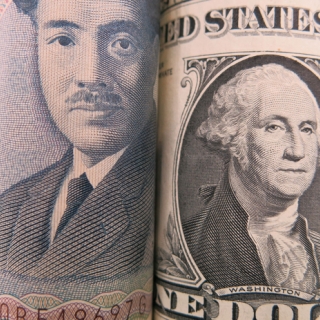

The US Dollar Index (DXY), a measure of the value of the US Dollar (USD) against a basket of six major currencies, attracted some buyers around 103.50 during the early European session on Wednesday (3/19). Traders are preparing for the Federal Reserve's (Fed) interest rate decision later on Wednesday, with no change in interest rates expected.

Fed officials' fresh economic projections will be closely watched as they could provide some clues on how policymakers view the possible impact of US President Donald Trump's administration's policies.

Technically, the bearish outlook for the DXY remains in place, as the index is holding below the key 100-day Exponential Moving Average (EMA) on the daily timeframe. The path of least resistance is to the downside as the 14-day Relative Strength Index (RSI), which is below the midline near 31.15, favors sellers in the near term. In a bearish event, the March 18 low of 103.20 acts as an initial support level for the USD index. The key level to watch is 102.00, which represents the psychological level and the lower boundary of the Bollinger Band. A sustained decline could lead to a drop to 100.53, the August 28, 2024 low.

On the upside, the immediate resistance level for the DXY comes in at 104.10, the March 14 high. Further north, the next hurdle is seen at 105.45, the November 6, 2024 high. Any follow-through buying above this level could lead to a rally to 106.10, the 100-day EMA.(Newsmaker23)

Source: FXstreet

The USD/CHF pair weakened for the third consecutive day and traded around 0.7960 in early European trading on Tuesday. The Swiss franc strengthened on increased demand for safe haven assets, following...

The US Dollar Index (DXY) trended sluggishly around 99.06 on Monday (January 19th), as liquidity thinned as US markets were closed for Martin Luther King Jr. Day. Despite limited movement, global sent...

The US dollar is expected to rise for a third straight day on Thursday (January 8), but trading remains cautious as investors position themselves ahead of Friday's Nonfarm Payrolls (NFP) report. Recen...

The dollar index edged up to 98.5 on Tuesday, its strongest level in more than two weeks, as investors focused on a slate of key economic data for the US. Recent indicators have pointed to some soften...

The US dollar opened 2026 weakly on Friday. Throughout last year, the dollar was pressured by many major currencies due to narrowing interest rate differentials between the US and other countries. Con...

Gold prices briefly caused a stir after hitting a new record, but then slowed. The main trigger: US President Donald Trump withheld the threat of tariffs on Europe and claimed there was a "framework" for a future agreement on Greenland. This calmer...

Oil prices were little changed in Asian trading on Thursday after US President Donald Trump backed down from a threat to impose tariffs on European countries over Greenland. This decision helped ease geopolitical tensions and improve market...

The Nikkei 225 Index climbed 1.73% to close at 53,689, while the broader Topix Index rose 0.74% to 3,616 on Thursday, snapping a five-day losing streak as Japanese shares were lifted by a strong rally in chip and artificial intelligence related...